What is Agile Budgeting?

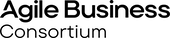

In an era characterised by rapid change and unpredictable challenges, the public sector is increasingly recognising the imperative for Strategic Agility; the capacity to effectively navigate and respond to dynamic environments. This critical organisational capability is built upon three fundamental components:

Yves Doz and Mikko Kosonen cemented the Strategic Agility concept in their book:

‘Fast Strategy: How Strategic Agility Will Help You Stay Ahead of the Game’

This infographic is a modified version of Figure 1.1 The Strategic Agility Concept1

It is within this vital dimension of resource fluidity that agile budgeting emerges as a transformative approach, empowering public sector entities to break free from rigid annual cycles. Instead, they can adopt an adaptive, continuous financial planning model that directly supports strategic responsiveness and drives value delivery.

In the public sector, agile budgeting represents a fundamental shift from rigid, annual financial planning to a more dynamic, adaptive, and iterative approach. Unlike traditional fixed budgets, which are often set annually and reviewed infrequently, agile budgeting embraces continuous re-evaluation and flexible resource allocation. It aligns financial decisions with the fluid needs of evolving projects, programs, and policy priorities. This enables government agencies to rapidly respond to changing demands, unforeseen challenges, and emerging opportunities by prioritising value delivery over strict adherence to pre-defined spending lines.

Why does public sector innovation need agile budgeting?

The imperative for agile budgeting in the public sector stems directly from the increasingly complex, interconnected, and rapidly evolving challenges governments face today.

From adapting to the swift pace of technological disruption and navigating dynamic geopolitical landscapes to managing global pandemics and addressing climate change impacts, public sector organisations can no longer afford to operate with static, annual financial frameworks. Traditional budgeting, often designed for stability and control rather than responsiveness, inherently stifles the rapid experimentation and iterative learning critical for modern innovation.2 Its rigid allocations and lengthy approval cycles create significant bureaucratic resistance and a cultural aversion to risk, hindering agencies from pivoting quickly or investing in emergent solutions.3

Countless promising innovation initiatives across government covering digital service transformations, new policy pilots, or AI driven projects have found themselves constrained, delayed, or even abandoned due to funding inflexibility.

Fixed budgets prevent the fluid reallocation of capital to more promising avenues, discourage low-cost experimentation, and penalise projects that demonstrate early failures, even if those failures offer invaluable lessons. This creates a persistent tension between the public sector's vital need for accountability (ensuring responsible use of taxpayer money) and the demand for agility (the capacity to innovate and adapt).

However, true accountability in a volatile world increasingly demands agility. Innovation, by its very nature, thrives on adaptive resource deployment, continuous feedback, and pivoting capability. Therefore, equipping the public sector with more adaptive financial systems, such as agile budgeting, is no longer a luxury but a strategic necessity to effectively serve citizens and achieve public mandates in the 21st century.

Core Principles of Agile Budgeting in the Public Sector

Translating the dynamic nature of agile methodologies into the often-rigid financial landscape of the public sector requires a thoughtful adaptation of core principles. While rooted in private-sector innovation, agile budgeting in government aims to foster financial flexibility without compromising essential oversight and public trust.

Here are five core principles that form a government-ready framework for agile budgeting:

Outcome Oriented Investment:

This principle mandates directing resources exclusively towards initiatives that deliver measurable public value and tangible outcomes. Budgets are directly tied to clearly defined, mission aligned goals and results, moving beyond mere activity funding to ensure that every investment directly contributes to citizen benefit and agency objectives.

Iterative Funding Cycles:

Instead of committing to large, multi-year appropriations upfront, funding is released in smaller, manageable increments tied to short, defined cycles (e.g., quarterly or bi-annually). This approach allows projects to demonstrate progress and validated value at each stage before receiving further investment, minimising financial risk and enabling frequent, structured re-evaluation points.

Dynamic Resource Reallocation:

Recognising that priorities and needs can shift rapidly, this principle establishes mechanisms that permit swift and flexible reallocation of approved resources within a budget period or across different initiatives. Budgets are treated as living instruments, allowing for rapid adjustments based on new data, emergent challenges, or validated opportunities, ensuring capital is continuously directed to where it can generate the highest current impact.

Lean Governance:

Moving beyond traditional siloed budgeting, this principle promotes open communication, clear financial transparency, and shared ownership across departments, policymakers, and relevant stakeholders. Accountability shifts from strict adherence to initial spending plans to collective responsibility for achieving agreed upon outcomes and adapting financial decisions responsibly.

Evidence-Based Decision-Making (Ignoring Sunk Costs):

This principle dictates that all future funding decisions must be based solely on current evidence and the potential for maximum future value. Continuous learning from project execution, outcome achievement, and changes in the operational or policy landscape directly informs these decisions. Crucially, past expenditures are explicitly treated as sunk costs and must not influence future investment choices, preventing the continuation of unviable initiatives due to prior commitments.

Key Strategies to Support Agile Budgeting Implantations in the Public Sector?

Implementing agile budgeting within the public sector requires more than just a conceptual shift; it demands tangible strategic changes to existing processes, structures, and tools. For government agencies looking to move towards more adaptive financial management, these key strategies can facilitate a successful transition:

- Transform Funding Structures & Allocation Models:

This strategy focuses on fundamentally reforming the mechanics of how funds are released and governed to enable continuous agility. It involves shifting away from rigid annual budget cycles towards rolling forecasts, responsive allocation models, and iterative funding increments (e.g., quarterly or biannually). This allows for continuous funding decisions based on validated progress and changing priorities and can include establishing dedicated agile or innovation funds designed for small scale, experimental projects with clear learning objectives, thereby enabling safe-to-fail approaches and evidence-based scaling.

- Cultivate Cross Functional Ownership & Collaborative Governance:

This strategy addresses the organisational and human elements critical for agile budgeting. It emphasises breaking down traditional silos by creating and empowering cross functional teams that bring together financial professionals, operational leaders, and policy developers. These teams collectively own project outcomes, resource decisions, and budgeting responsibilities. This integrated approach ensures financial planning is directly aligned with execution and strategic intent, fostering shared accountability and informed adjustments across the agency.

- Implement Data Driven Performance Management & Technology Enablement:

This strategy focuses on establishing the systems and tools necessary for continuous learning and adaptation. It involves building robust mechanisms for real time project evaluation, continuous performance tracking, and direct feedback loops from stakeholders and citizens. To support this, agencies must leverage modern technology tools, including advanced financial planning and analysis (FP&A) software, data visualisation platforms, and integrated government systems, to provide real time dashboards, enable dynamic forecasting, enhance transparency, and facilitate rapid, evidence-based decision-making.

By focusing on these actionable strategies, public sector organisations can begin to dismantle the barriers to financial agility, paving the way for more responsive, effective, and innovative governance.

What are Innovation Labs and How Can They Help?

Innovation Labs serve as dedicated environments within or alongside public sector organisations, specifically designed to foster experimentation, creative problem solving, and the development of novel solutions to complex public challenges.4 They are spaces (whether physical, virtual, or hybrid) where traditional bureaucratic constraints are intentionally lessened to allow for agility, rapid prototyping, and user centric design. Their primary roles include exploring emerging technologies, redesigning public services, developing new policy approaches, and cultivating an innovation friendly culture within the broader organisation.5

These labs are uniquely positioned to be powerful enablers of agile budgeting. They can actively model, prototype, and scale agile budgeting experiments within a controlled, lower risk environment. For instance, a lab might pilot an incremental funding model for a specific project, track real time resource utilisation, and demonstrate the efficiency gains before advocating for broader adoption across the organisation. By conducting these practical demonstrations, labs provide empirical evidence that can de-risk the transition to agile financial practices. Renowned public sector labs, such as GovTech Singapore, have successfully showcased how dedicated innovation units can test new operational and financial approaches.

GovTech Singapore lab, typically receives funding through small, initial budgets for pilot projects6. This enables the lab to conduct a series of iterative experiments (or sprints) to quickly develop minimum viable products (MVPs) and validate ideas on a small scale before committing to more substantial resources. GovTech focuses on streamlining compliance and procurement frameworks for its projects. This includes introducing "Tender Lite" and dynamic contracts to reduce bureaucracy and enable more agile, cost-effective collaboration with private sector vendors.

Another notable example is the Public Transformation Hub, known in French as the Lieu de la Transformation Publique (LTP). This key service of the Inter-ministerial Directorate for Public Transformation functions as a network of innovation labs and experts, supporting government administrations in their transformation projects by promoting a human-cantered approach to public policy and service design. The LTP also incorporates a form of agile budgeting principles.

Beyond financial practices, innovation labs exert significant influence on policy and resource reallocation.7 They act as sandboxes for policy innovation, testing the feasibility and impact of new regulations or service delivery models before widespread implementation.8 Their outputs directly inform policy adjustments, demonstrating where resources are most effectively utilised. By encouraging an evidence-based approach to decision making, labs can advocate for the reallocation of funds from less effective traditional programs to more impactful, agile initiatives that have proven their value within the lab's experimental context. This positions them as crucial catalysts for embedding agility not just in budgeting, but across the entire operational and strategic fabric of government.

Putting it all together, the public sector is compelled to move beyond rigid annual financial planning. Agile budgeting emerges as a transformative approach, enabling continuous re-evaluation and flexible resource allocation directly aligned with evolving priorities and value delivery.

Innovation Labs play a crucial role as dedicated environments for experimentation and problem solving, intentionally lessening bureaucratic constraints. They are uniquely positioned to model and prototype agile budgeting within a controlled, lower risk setting. Agile budgeting is becoming the norm in many innovation labs, where small, initial budgets for pilot projects enable iterative development and validated learning.

While these labs effectively demonstrate the power and practicality of agile budgeting at a project or unit level, the significant challenge remains on how to successfully scale this agile budgeting concept to the broader, organizational level of public entities. This requires overcoming deeply rooted traditional financial frameworks and fostering a cultural shift towards continuous adaptation and outcome-based resource management.

Samir Abu Ghosh will be speaking at our Agile Business Conference on the Agility in Finance panel. Make sure to register here!

References:

2 https://www.jedox.com/en/blog/why-traditional-budgeting-methods-are-failing/

4 https://www.vationventures.com/glossary/innovation-lab-definition-explanation-and-use-cases

5 https://oecd-opsi.org/blog/innovation-labs-cant-do-it-all/

8 https://oecd-opsi.org/blog/innovation-labs-through-the-looking-glass/

Core Principles Sources:

- https://us.agiledigest.com/budgeting-in-a-lean-agile-framework/#:~:text=Greater%20Accountability%3A%20Tie%20budget%20allocations,to%20focus%20on%20delivering%20results

- https://triskellsoftware.com/blog/lean-budgeting/

- https://www.growingscrummasters.com/keywords/incremental-funding-method/#:~:text=Rather%20than%20securing%20all%20funding,success%20and%20delivers%20working%20features

- https://www.cprime.com/resources/blog/how-to-establish-lean-budgets-for-agile-success/

- https://hypersense-software.com/blog/2023/07/14/mastering-agile-project-budgeting/#:~:text=Continuous%20Monitoring%20and%20Feedback,-One%20of%20the&text=Regularly%20review%20your%20budget%20against%20actual%20spending%20and%20adjust%20as%20needed.

Strategies Sources:

- https://fpa-trends.com/article/integrated-fpa-end-siloed-planning

- https://hypersense-software.com/blog/2023/07/14/mastering-agile-project-budgeting/#:~:text=Continuous%20Monitoring%20and%20Feedback,-One%20of%20the&text=Regularly%20review%20your%20budget%20against%20actual%20spending%20and%20adjust%20as%20needed.

- https://www.freshworks.com/agile-project-management/

- https://www.savvy-cfo.cpa/current-matters/comprehensive-guide-to-financial-planning-and-analysis-fpa